-

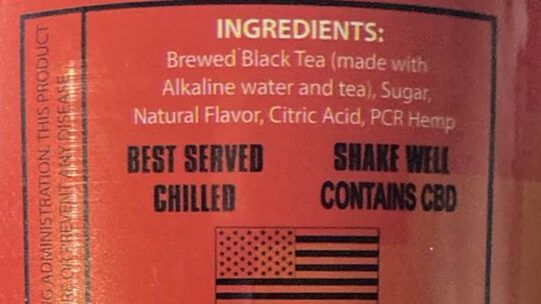

The Quiet Revolution of Hemp Beverages: From Farm to Bottle

Read more: The Quiet Revolution of Hemp Beverages: From Farm to BottleIt begins in the fields—vast acres of hemp swaying gently under the sun. Once a stigmatized crop, hemp is now a key ingredient in an…

-

The Digital Storytelling Strategy Driving Hemp Beverage Popularity

In the ever-evolving cannabis space, hemp beverages have carved out a niche that blends wellness, lifestyle, and innovation. Yet, what separates brands that thrive from…

-

White Label Cannabis Goods: Where Do Hemp Beverages Fit In?

In the growing cannabis and hemp marketplace, white label products have become a fast way for brands to launch without building full production facilities. Gummies,…